XAUUSD, Trading, Big Money, Accumulation and Thoughts..

- Smart Money Cult

- Feb 18, 2025

- 4 min read

This space has been in works for a while and will be under construction for a bit longer. As it develops, it will be where I primarily share my thoughts since social media would likely flag the content for being too "offensive."

Except a whole lot of trading and a fair share of other things that I delve into here. Given this is the first post here, why not start with XAU/USD and a multi-timeframe ("TF") analysis? Those of you who know me, you know my love for every single instrument and XAU delivers like a bomb each time it sets up (like it has been).

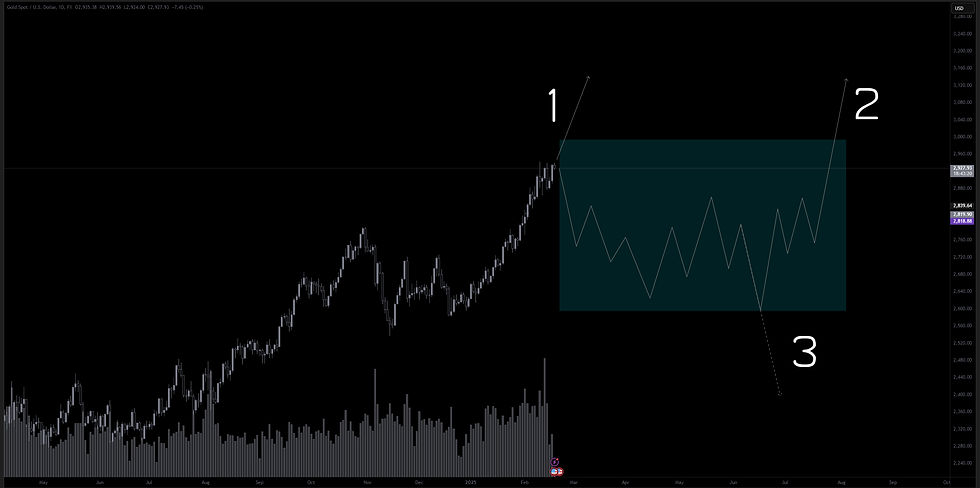

If anything, the longer-term trend clearly indicates that the instrument WANTS to move in a given direction. If the above chart does not showcase that direction to your eyes, then you should probably not be trading it. Although this is a monthly chart, most traders/investors never care to expand their timeframes (TFs), which leads to blown accounts, liquidations, FOMO, and most importantly, the feeling of “I need a new strategy.”

Remember when you started out (or even now), and often thought that every break of structure was an opportunity to position yourself to the other side? You should be 100% willing to make mistakes but the most important ability to learn is to improve.

Does this mean that you would not be profitable trading the other side in the above instrument?

NO. The simple rule for profitability is following the trend that is showcased to your eyes.

There's about 58,200 stocks available globally to trade, and literally countless other instruments that showcase a clear direction. One could capitalize on a single instrument with a trending direction to become profitable.

The above is XAU/USD on a daily, which continues ripping to the upside because, why? Because it is simply following the trend. While some of you may argue that there is a difference of ~45% from the swing high (2011) and swing low (2015) which is enough to fuel your personal accounts, but notice how you'd get liquidated more than enough times to make those small gains?

The big money always sets the direction for an instrument, and retail traders become easy liquidity as they often go against the trend. Guess what happens next? Your positions that get liquidated are nothing but accumulation blueprints left behind in the charts.

Take a careful look at the blue (or whatever the fuck colour it is) area and observe what happens there. These are accumulation areas, and the actions of big money are easily identifiable on the charts because price movements cannot be hidden. Easy and profitable systems revolve around positioning in these areas. There are various ways to enter, but you must be willing to relearn how to read price and, most importantly, how to enter and manage your positions. Cryptic much? Patience...

As of right now, Gold is solid and the big money is simply just pushing the price where it's making money for them. Once the money decides that more liquidation is required, the price would accumulate on higher TF but since price is fractal, there is enough accumulation and distribution that happens on the lower TF to continue the momentum and liquidate the retail day traders on a daily.

There are only three possible outcomes from here on..

1. A run to new highs,

2. Another base creation (potential accumulation) and

3. A base creation as well (potential distribution).

What do you think is a high quality setup, considering what you just read? What is more likely to protect your risk and give you sustainable gains over the longer run? Trading is all about managing and protecting your risk. scenario 1 is ready to run, but you are more likely to benefit from the occurrence of the scenario only if you are lower timeframe trader. In that case, you can position yourself and ride the trend.

However, you are a High TF ("HTF") trader, you might be better off waiting for scenario 2. This will definitely help you get into a better position potentially resulting in more breakeven trades than losses before running.

Scenario 3 is once the distribution is confirmed and price starts moving below the created base.. In that case, you could load on your shorts (I personally wouldn't simply because the Risk:Reward vs move potential is not favourable) to target some liquidity areas because remember that you are still in a long term bullish trend.

If you are shorting this right now, anticipating the instrument to drop like a knife, you're clearly gambling. This might work a couple of times, but one liquidation is all it takes to destroy your gains, possibly fuck your trading psychology and potentially blow your funded/personal account.

On another note, Dota 2 just dropped Patch 7.38 so I'm off to read the patch notes and prepare for the next trading session.

This is feast to my eyes! GG!